If you’ve ever fallen in love with a Korean serum or sunscreen that went viral on TikTok, there’s a good chance it didn’t actually come from the brand’s own factory. Behind many of the most-hyped K-beauty products sit two quiet giants: Kolmar Korea and Cosmax. These original design manufacturers (ODMs) are the engine rooms of K-beauty, turning brand concepts into stable, scalable, regulation-ready formulas that can ship to Sephora, Olive Young and Amazon worldwide.

For founders, marketers and beauty lovers who want to understand where their favorite products really come from, it’s time to look past the pretty bottles and into the manufacturing floor.

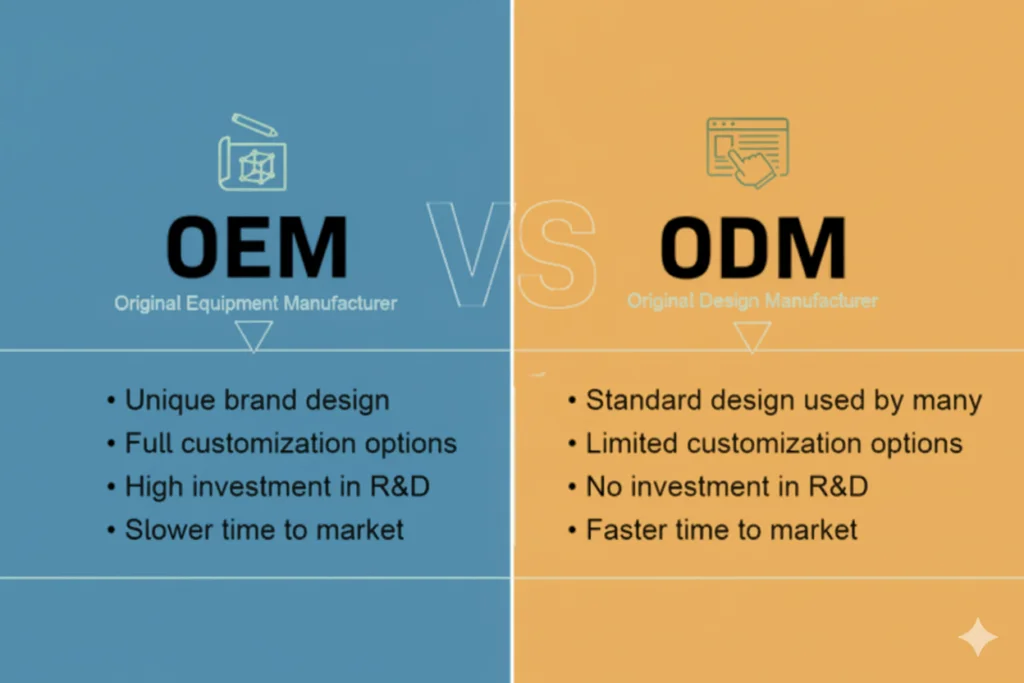

OEM vs ODM: How K-Beauty Really Gets Made

Most K-beauty brands don’t build their own factories. Instead, they partner with OEM/ODM specialists.

OEM (Original Equipment Manufacturer): The brand provides the formula or very tight specs, and the manufacturer produces it under the brand’s name.

ODM (Original Design Manufacturer): The manufacturer is deeply involved in R&D, product concept, formulation, testing and scale-up, then supplies finished products that brands label and sell as their own.

In Korea, ODM is the dominant model. Companies like Kolmar and Cosmax run sophisticated labs, monitor global regulations, track ingredient trends and maintain large production lines. Brands—especially indie labels and digital-native start-ups—can focus on storytelling, branding and distribution, while the ODM handles the science and compliance.

This model explains why K-beauty is so fast at responding to trends. If a brand wants a cushion foundation, cica serum or SPF essence tomorrow, chances are there’s already a base formula in an ODM library that can be customized quickly, then scaled to millions of units once demand takes off.

Why K-Beauty OEMs Matter More Than Most Consumers Realise

K-beauty’s global reputation for texture, innovation and efficacy is not only about clever marketers—it’s built on a manufacturing ecosystem that has been refining its craft for decades.

Recent analyses of Korea’s cosmetics ODM industry show that Cosmax and Kolmar together hold a leading share of the market, with Cosmax estimated at around 14–18% and Kolmar at 12–15%. These are not niche suppliers; they’re global operators that shape what “K-beauty” looks and feels like from New York to Jakarta.

For consumers, that means:

- Different brands can share the same manufacturer and even similar base technologies.

- Quality, stability and safety often reflect the standards of the ODM, not just the storytelling on the outer box.

- Viral hits are rarely accidents—they’re the result of an ODM’s ability to combine good science, trend-driven actives and industrial-scale consistency.

Let’s look at the two biggest names driving this system: Kolmar Korea and Cosmax.

Kolmar Korea: The First-Mover That Built the ODM Template

Kolmar Korea is widely credited as the first company to introduce the cosmetics ODM business model to Korea, starting in 1990. What began as a contract manufacturer has evolved into a global top-tier ODM that collaborates with thousands of brands across skincare, makeup and even health supplements.

From Low-Cost Lines to Viral Darlings

Historically, Kolmar helped power the rise of Korea’s first wave of accessible beauty brands. In the 2000s, labels like Missha, The Face Shop, Innisfree and Etude House leaned heavily on Kolmar and fellow ODMs to produce affordable but effective colour and skincare products, allowing them to focus on rapid retail expansion.

Today, Kolmar’s client list spans everything from legacy conglomerates Amorepacific and LG Household & Health Care to newer digital darlings like Beauty of Joseon and SKIN1004, which have become best-sellers on global e-commerce platforms like Amazon.

For many of these brands, Kolmar provides:

- Concept-to-shelf development: From trend research and ingredient strategy to stability testing.

- Sophisticated R&D: Around 30% of its employees are researchers, and the company reinvests 5–7% of annual sales into R&D, a significant figure for a manufacturer.

- Global compliance support: Helping brands meet regulatory needs across North America, Europe and Asia.

Ingredient-Led, Research-Heavy

As K-beauty moves into its “ingredient-led” era—think rice bran, ginseng, centella, mugwort—Kolmar has leaned hard into traditional Korean botanicals and novel actives. The company promotes products that pair “uniquely Korean” natural ingredients with modern delivery systems, particularly in cleansers and masks designed for global consumers.

This ingredient expertise is a key reason brands choose them. A small label might have a strong branding idea (“a minimalist hanbang line for sensitive skin”), but it’s Kolmar’s ability to translate that into stable emulsions, replicable textures and clinically supported claims that makes the product retail-ready.

Cosmax: The Innovation Powerhouse Behind K-Beauty Icons

If Kolmar pioneered the ODM model domestically, Cosmax turned it into a global innovation platform.

Cosmax describes itself as the “global no. 1 ODM group for beauty and health products,” serving more than 1,000 customers worldwide, including multinational giants like L’Oréal. It has facilities in Korea, China, the United States and beyond, allowing multinational clients to develop region-specific lines while maintaining centralised R&D.

Inventor of Category-Defining K-Beauty Products

Cosmax’s own sustainability and corporate reports highlight its role in inventing some of K-beauty’s most recognisable product categories, including CC cream, gel eyeliner and cushion foundations—formats that quickly moved from Korean road-shop shelves to mainstream Western brands.

That innovation track record is why so many brands, both Korean and global, see Cosmax as their go-to partner when they want something more than a “me-too” formula.

Regulatory Muscle and Technical Depth

One of Cosmax’s major advantages is its regulatory and technical infrastructure. It was the first Korean cosmetics ODM to pass over-the-counter (OTC) drug and cosmetics registrations with the US FDA and Health Canada, and it holds additional certifications such as international halal credentials and ECOCERT for natural/organic standards.

Recent moves include:

- Setting up a dedicated sun care lab to help clients crack the complex US sunscreen market, which has stringent regulatory and testing requirements.

- Collaborations with materials players like LG Chem to develop eco-friendly packaging solutions aimed at global prestige and mass brands alike.

In an era where SPF filters, labeling rules and sustainability expectations change rapidly, this level of regulatory and technical support is invaluable for brands that want to launch in multiple markets simultaneously.

Kolmar vs Cosmax: Healthy Rivalry, Better Products

Industry analyses and local business media frequently position Kolmar and Cosmax as direct rivals for ODM supremacy, both chasing multi-trillion-won revenue targets and expanding their global footprints.

For the end consumer, that competition is a feature, not a bug. It pushes both players to:

- Shorten development timelines without compromising on safety

- Explore new textures (jelly serums, balm sticks, hybrid sun-serum formats)

- Invest in sustainability, from eco-certified ingredients to less wasteful packaging

- Support smaller indie brands, not just huge conglomerates, knowing that the next viral hit could come from TikTok rather than a department store counter

That’s why you often see a wave of similar product types hitting the market at once: when one ODM refines a technology and brands start showcasing it, others race to match or out-innovate.

What This Means If You’re Building a K-Beauty Brand

For founders and product teams, understanding OEM/ODM dynamics is no longer optional. Choosing between Kolmar, Cosmax or another manufacturer can shape everything from your hero textures to your margin structure.

Here’s what typically happens behind the scenes:

- Briefing & Positioning: You bring a concept—“a barrier-repair cream for dehydrated, urban skin,” or “a fragrance-free sunscreen for sensitive skin that doesn’t pill under makeup.” The ODM provides a menu of base formulas, actives and texture options aligned to your positioning and target region.

- Lab Samples & Iteration: The lab creates multiple samples, tweaking viscosity, scent, finish and absorption speed. K-beauty’s reputation for sensorial excellence is very much born at this stage; a good ODM will push back when something feels off-brand for your market.

- Stability, Safety & Claims: The ODM runs stability tests (heat, light, time), microbiological checks and compatibility tests with your packaging. For certain claims—“non-comedogenic,” “SPF 50+ PA++++,” “anti-wrinkle”—they arrange or coordinate the necessary clinical or instrumental testing.

- Scale-Up & Globalisation: Once you approve the lab batch, the formulation is scaled to full manufacturing. For global launches, the same ODM may help localise the formula (e.g., respecting US SPF regulations, EU allergen labeling, halal requirements) and prepare dossiers for different authorities.

The upshot: the manufacturer becomes your de facto R&D arm. Brand owners who grasp this can ask smarter questions, negotiate better and ultimately deliver better products.

How Can You Tell If Your Favourite Korean Serum Comes From an ODM?

Brands rarely publicise their OEM/ODM partners, and companies like Kolmar explicitly avoid naming client lists in public to respect confidentiality agreements. But there are patterns:

- Products across different brands can have strikingly similar textures or INCI lists. Many new indie labels proudly state “Made in Korea” while being headquartered elsewhere—often a clue that an ODM is doing the heavy lifting.

- Industry insiders, trade media and even Reddit communities frequently discuss which manufacturer sits behind popular items, with Kolmar, Cosmax and Cosmecca recurring as the “big three.”

For consumers, this isn’t a red flag. If anything, it’s reassuring: a seasoned ODM is more likely to ensure consistent quality, batch after batch, than a tiny in-house lab stretched to capacity.

The Future of K-Beauty Manufacturing

Looking ahead, K-beauty manufacturing is evolving along three big fault lines—and Kolmar and Cosmax are both adjusting in real time.

- Sustainability & Cleaner Formulations: Expect more work on biodegradable packaging, recycled plastics, refill systems and water-saving production processes. Cosmax’s partnership with LG Chem on eco-friendly containers is one example of this shift.

- Hyper-Localized Innovation: As K-beauty becomes truly global, ODMs are adjusting formulas for different climates, skin tones and regulatory environments, from Southeast Asia’s humidity to North America’s sun care rules. Their global R&D and factory networks are crucial tools for this localisation.

- Data-Driven Product Development: With TikTok, DTC reviews and retailer feedback coming in at high speed, ODMs are increasingly using data from multiple brands and markets to spot gaps in real time—then offering “white-space” concepts to their partners before competitors move.

In all of these areas, OEM/ODM giants aren’t just reacting to trends; they are co-authoring what the next wave of K-beauty looks like.

Final Thoughts: Give Credit to the Labs, Not Just the Labels

K-beauty’s success story is often told through charismatic founders, photogenic packaging and clever social media campaigns. But behind the glow lies a deeply industrial, highly technical ecosystem—one where companies like Kolmar Korea and Cosmax play starring roles.

They are the quiet collaborators behind cushion compacts that changed the foundation game, sunscreens that finally feel like skincare, and serums that go viral not just because of pretty pastel branding, but because the formulas genuinely work.

For beauty brand owners, understanding these OEM/ODM partners is as strategic as understanding TikTok’s algorithm. For consumers, recognising the power of manufacturers demystifies the industry and highlights what really matters: robust R&D, strong quality control and thoughtful ingredients.

The next time you pat in a viral K-beauty essence or reapply that feather-light SPF, remember: the logo on the bottle may belong to a brand—but the invisible fingerprints on the formula often belong to an ODM in Seoul.

One Comment